Supply & Demand

Transformative tailwinds

Ongoing geopolitical events, energy security concerns, and the global focus on the climate crisis amid rising low-carbon energy demand have created what we believe are transformative tailwinds for the nuclear power industry, from both a demand and supply perspective.

The unrest in Kazakhstan at the outset of 2022 raised concerns about the more than 40% of global uranium supply that originates from Kazakh mines. However, it was the Russian invasion of Ukraine in late-February 2022 that was the most transformative event for our industry.

The war continues to broadly impact our market in 2023 with parts of Ukraine, including the Zaporizhzhia Nuclear Power Plant, remaining under Russian control. We believe these developments have set in motion a geopolitical realignment in energy markets that is highlighting the increasingly important role for nuclear power not just in providing clean energy, but also providing secure and affordable energy.

With the global nuclear industry reliant on Russian supplies for approximately 13% of uranium concentrates, 25% of conversion and 37% of enrichment, the realignment is also highlighting the security of supply risk associated with the growing primary supply gap and shrinking secondary supplies, while increasing the focus on origin of supply.

Uncertain supply

Despite the recent increase in market prices, the deepening geopolitical uncertainty and years of underinvestment in new uranium and fuel cycle service capacities has shifted risk from producers to utilities. In addition to the decisions many producers, including the lowest-cost producers, have made to preserve long-term value by leaving uranium in the ground or idling capacity, there have been a number of unplanned supply disruptions and associated supply chain challenges on uranium mining and processing activities. Geopolitical uncertainty remained the most notable factor impacting security of supply in 2023. Driven by the Russian invasion of Ukraine, and more recently, the coup d’état in Niger, many governments and utilities are re-examining supply chains and procurement strategies that rely on nuclear fuel supplies from these jurisdictions.

Uranium is a highly trade-dependent commodity. Adding to security of supply concerns is the role of commercial and state-owned entities in the uranium market, and trade policies that highlight the disconnect between where uranium is produced and where it is consumed. Nearly 80% of primary production is in the hands of state-owned enterprises, over 70% comes from countries that consume little-to-no uranium and nearly 90% of consumption occurs in countries that have little-to-no primary production.

As a result, government-driven trade policies and, most recently, actions taken in response to Russia’s invasion of Ukraine, can be particularly disruptive for the uranium market.

Increasing demand

The world needs safe, clean, reliable electricity. With many countries looking to reindustrialize and nationalize sourcing capabilities, at COP28 in 2023, global leaders, heads of state and industry leaders acknowledged that it is not possible to achieve net-zero carbon emissions (net-zero) without nuclear power and pledged to triple generating capacity by 2050. In addition, there is increasing demand for reliable, uninterrupted power supplies to underpin large, energy-intensive industries, with recognition from within those sectors that baseload nuclear power is on the critical path for achieving the anticipated transformations with secure and carbon-free sources.

The benefits of nuclear energy have come clearly into focus with a durability we believe has not been previously seen. This is driven by the accountability created by the net-zero carbon targets being set by countries and companies around the world. These targets are turning attention to a triple challenge:

- First, is to lift one-third of the global population out of energy poverty by growing clean and reliable baseload electricity.

- Second, is to replace 85% of the current global electricity grids that run on thermal power with a clean, reliable alternative.

- And finally, is to grow global power grids by electrifying industries, such as private and commercial transportation, home, and industrial heating, largely powered with thermal energy today.

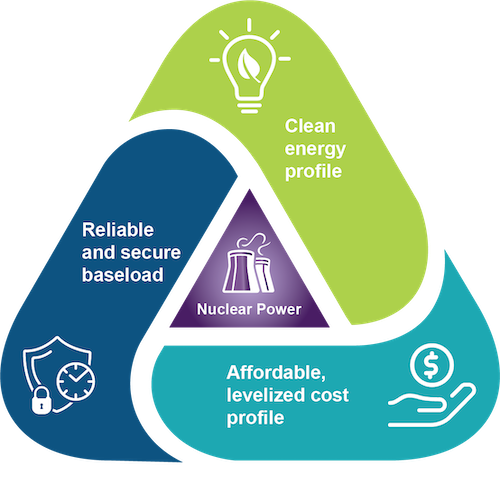

The energy crisis experienced in some parts of the world has amplified concerns about energy security and highlighted the role of energy policy in balancing three main objectives:

- providing a clean emissions profile;

- providing an affordable levelized cost profile; and

- providing a reliable and secure baseload profile.

The IEA World Energy Outlook predicts a 52% increase in electricity demand from 2020 to 2040, with a 75% increase predicted from 2020 to 2050.

| Future estimates | Historic | |

| 1990 | 10092 | |

| 2000 | 15441 | |

| 2021 | 28334 | |

| 2030 | 35 802 | |

| 2040 | 45418 | |

| 2050 | 53985 |

There is increasing recognition that nuclear power, with its clean emissions profile, reliable and secure baseload characteristics and low, levelized cost has a key role to play in achieving decarbonization goals.

According to the International Atomic Energy Agency there are currently 441 reactors operating globally and 59 reactors under construction.

| Number of Reactors | |

| China | 25 |

| Asia | 10 |

| India | 7 |

| Africa & Middle East | 5 |

| Russia | 4 |

| Eastern Europe | 3 |

| Americas | 2 |

| UK | 2 |

| EU | 1 |

Supply-Demand: Putting it Together

With increasing supply risk caused by production challenges and heightened geopolitical uncertainty, utilities are evaluating their nuclear fuel supply chains. As a reliable, commercial supplier, with nuclear fuel assets in geopolitically stable jurisdictions, we are focused on working with our customers to secure long-term commitments that will underpin the long-term operation of our productive capacity, while helping de-risk their nuclear fuel supply chains.

With our contracting success, we are heavily committed under long-term contracts. As of June 30, 2024, we have commitments requiring deliveries averaging about 29 million pounds of uranium per year from 2024 through 2028, with commitment levels higher than the average in 2024 and 2025, and lower than average in 2026 through 2028. As of December 31, 2023, our total portfolio of long-term contracts included commitments for approximately 205 million pounds of uranium. These commitments only represent about 20% of our current reserve and resource base, providing us with a great deal of exposure to improving demand from our customers as they look to secure their long-term needs. We continue to focus on obtaining market-related pricing mechanisms, while also providing adequate downside protection.

In addition, with strong demand in the UF6 conversion market, we added new long-term contracts that bring our total contracted volumes to over 75 million kgU of UF6.

Our strategy of contracting discipline, operational flexibility, supply discipline, and financial discipline positions us to achieve our vision, of “energizing a clean-air world” and delivering long-term value in a growing market.

| Spot Market | Long Term Market | Average Spot Price | |

| 2004 | 20 | 84 | 18.6 |

| 2005 | 36 | 252 | 28.67 |

| 2006 | 35 | 200 | 49.6 |

| 2007 | 20 | 250 | 99.29 |

| 2008 | 43 | 130 | 61.58 |

| 2009 | 54 | 150 | 46.06 |

| 2010 | 50 | 250 | 46.83 |

| 2011 | 56 | 112 | 56.36 |

| 2012 | 43 | 193 | 48.4 |

| 2013 | 50 | 24 | 38.17 |

| 2014 | 43 | 77 | 33.21 |

| 2015 | 49 | 81 | 36.55 |

| 2016 | 46 | 60 | 25.64 |

| 2017 | 48.1 | 73.1 | 21.78 |

| 2018 | 88.5 | 89.9 | 24.59 |

| 2019 | 63.3 | 95.8 | 25.64 |

| 2020 | 94.5 | 57.4 | 29.96 |

| 2021 | 102.41 | 71.79 | 35.28 |

| 2022 | 60.85 | 113.00 | 49.81 |

| 2023 | 55.03 | 159.60 | 62.51 |

Caution about Forward-Looking Information

Please click here for additional information about the assumptions applied in making the forward-looking statements on this page and the factors that could cause results to differ materially.